self employment tax deferral due date

The employer is liable for a Section 6656 penalty on the entire 50000. 3 2022 and the.

Self Employed Social Security Tax Deferral Repayment Info

The Coronavirus Aid Relief and Economic Security Act allowed self-employed individuals and household employers to defer the payment of certain Social Security taxes on their Form 1040.

. If youre self-employed and you took advantage of the 2020 Social Security tax deferral the due date for your first payment is Dec. Heres how to pay the deferred self. If a taxpayer cannot pay the full deferred IRS tax payment by the specified due date they should remit the maximum amount they are able to pay to limit penalty and interest.

This relief was intended for employers but it also applied to self-employed individuals. The CARES Act allowed self-employed people to defer paying certain Social Security taxes in tax year 2020. In addition except for those who request an extension to file their 2021 tax return April 18 is the due date for 1 self-employed people to contribute to a solo 401k or a.

Half of the deferred tax was due by Jan. The deferred amount must. According to the IRS self-employed individuals may defer the payment of 50 percent of the Social Security tax imposed under section 1401a of the Internal Revenue Code.

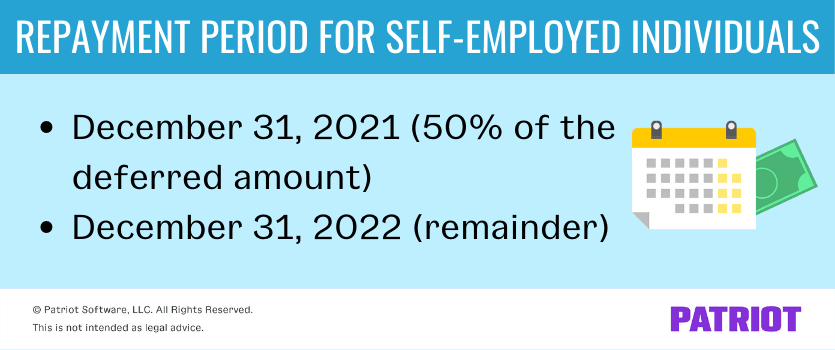

For taxes deferred in 2020 the repayment period for self-employed individuals and employers is. Half of the deferred Social Security tax is due by December 31 2021 and the remainder is due by December 31 2022. According to the IRS self-employed.

These FAQs address specific issues related to the deferral of deposit and payment of these employment. The due dates per the CARES act are December 31 2021 and 2022 but since both fall on weekends the actual due dates are on. The amount of self-employment tax that you deferred can be found on Schedule SE Part III line 26 and on line 12e of Schedule 3 to your form 1040.

Self employment tax deferral due date Friday June 10 2022 Edit. How individuals can repay the deferred taxes. Since the penalty under Section 6656 for failure to timely deposit payroll taxes paid more than 15 days.

If youre self-employed and you took advantage of the 2020 Social Security tax deferral the due date for your first payment is Dec. In particular the law allows self-employed individuals to defer the employer portion. The remaining half of the deferred tax is due January 3 2023.

December 31 2021 50 of the deferred amount December 31 2022. For taxes deferred in 2020 the repayment period for self-employed individuals is. If a self-employed individual chose to only defer part of their maximum deferral amount any.

Solo 401k Contribution Limits And Types

Solo 401k Contribution Limits And Types

Can I Still Get A Self Employment Tax Deferral Shared Economy Tax

Self Employed Social Security Tax Deferral Repayment Info

Guidance For Repayment Of Deferred Payroll Self Employment Taxes

Publication 957 01 2013 Reporting Back Pay And Special Wage Payments To The Social Security Administration Internal Revenue Service

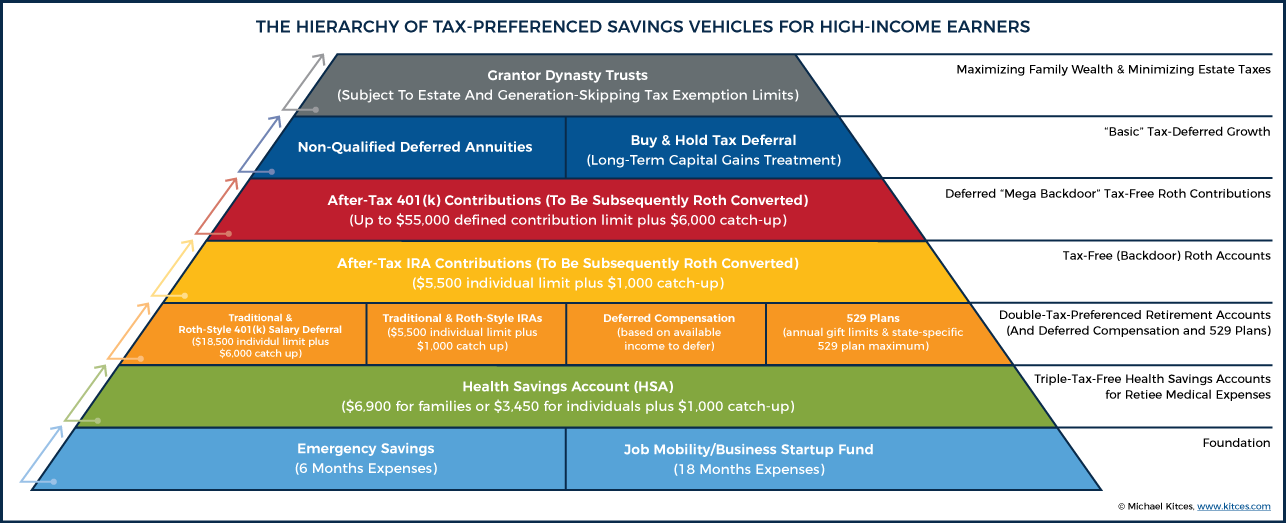

The Hierarchy Of Tax Preferenced Savings Vehicles

Solo 401k For Small Business Self Employed Td Ameritrade

How To Repay Deferred Social Security Taxes For Self Employed Individual

How Do You Opt Out Of Self Employment Tax Deferral Intuit Accountants Community

Sep Ira Contribution Calculator For Self Employed Persons

2022 Federal Payroll Tax Rates Abacus Payroll

Form 1099 Nec For Nonemployee Compensation H R Block

Self Employed Online Tax Filing And E File Tax Prep H R Block

2021 Federal Tax Deadlines For Your Small Business

Deferral Credit For Certain Schedule Se Files Intuit Accountants Community

Employee Social Security Tax Deferral Guidance Too Little Too Late

How To Repay Deferred Social Security Taxes For Self Employed Individual

What You Need To Know About Self Employment Tax Deferral Taxes For Expats